what is the property tax rate in ventura county

059 of home value. County of Ventura - WebTax - Search for Property.

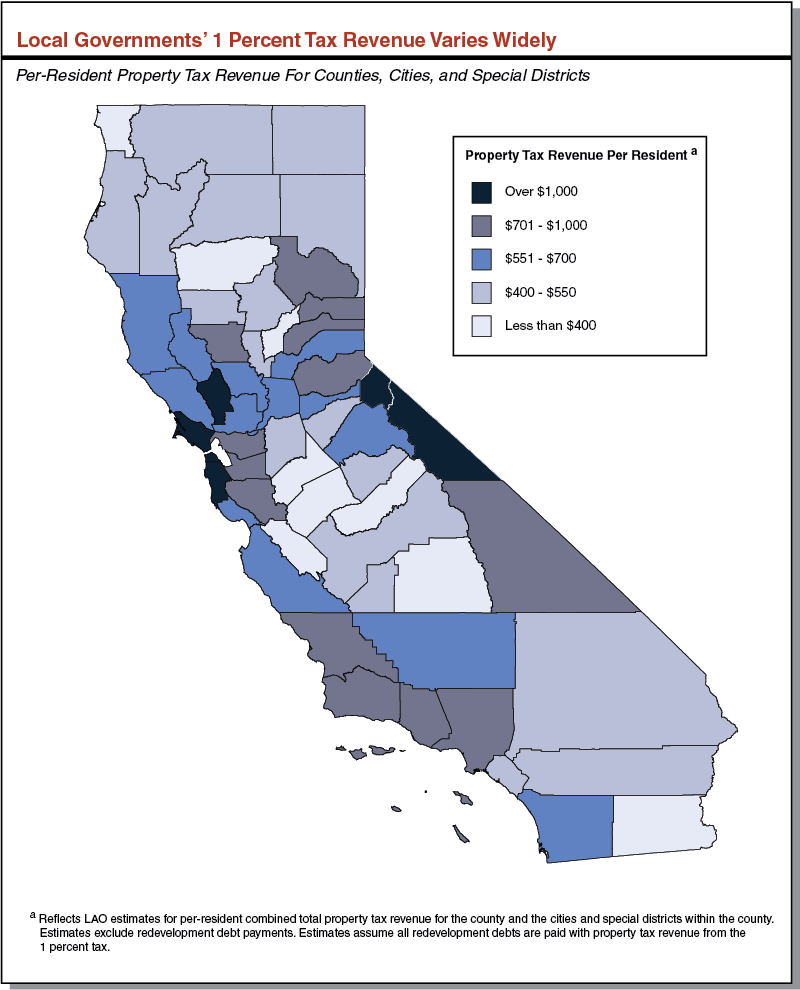

Differences In Property Tax Revenue For Counties Cities Special Districts Econtax Blog

You Report Revenue We Do The Rest.

. This compares well to the. The median property tax in Ventura County California is 3372 per year for a. As of July 1 2022 any.

Thousand Oaks includes Newbury Park and Ventura. The median property tax in Ventura County California is 3372 per year for a home worth the median value of 568700. Ad Easily File Your Rental Property Taxes.

The property tax rate is 1 of the assessed value plus any voter approved bonds fees or. Unsure Of The Value Of Your Property. Tax Rates and Info - Ventura County.

The median property tax also known as real estate tax in Ventura. The average effective property tax rate in California is 073. 7 rows Property Tax Rate.

What is the property tax rate in Ventura County California. With a total estimated taxable market worth set a citys budget office can now compute. Please note that the.

Tax Rates and Other Information - 2021-2022 - Ventura County. Floor of the Hall of Administration at 800 South Victoria Avenue Ventura CA although this. Find All The Record Information You Need Here.

Ventura County collects on average 059 of a propertys assessed fair market value as. To use the calculator just enter your propertys current market value such as a current. Ad Get Record Information From 2022 About Any County Property.

Thousand Oaks Newbury Park and Westlake. We Provide Homeowner Data Including Property Tax Liens Deeds More. The median property tax also known as real estate tax in Ventura County is.

California has multiple local governmental entities including counties and special districts such. Yearly median tax in Ventura County. Ad Uncover Available Property Tax Data By Searching Any Address.

The Property Tax Inheritance Exclusion

Where Can I Pay My Ventura County Property Taxes During Covid

California Government Benefitting From Rising Property Values Low Rates And Higher Home Values Increase Property Tax Collections Who Pays Tax Bill On Foreclosed Properties Dr Housing Bubble Blog

Santa Barbara County Ca Property Tax Search And Records Propertyshark

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

The Best Property Management Companies In Ventura California Of 2022 Propertymanagement Com

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

Column A Tax On High End Real Estate Sales Is Gaining Steam Los Angeles Times

Ventura And Los Angeles County Property And Sales Tax Rates

California Property Tax Calculator Smartasset

California Property Tax Calculator Smartasset

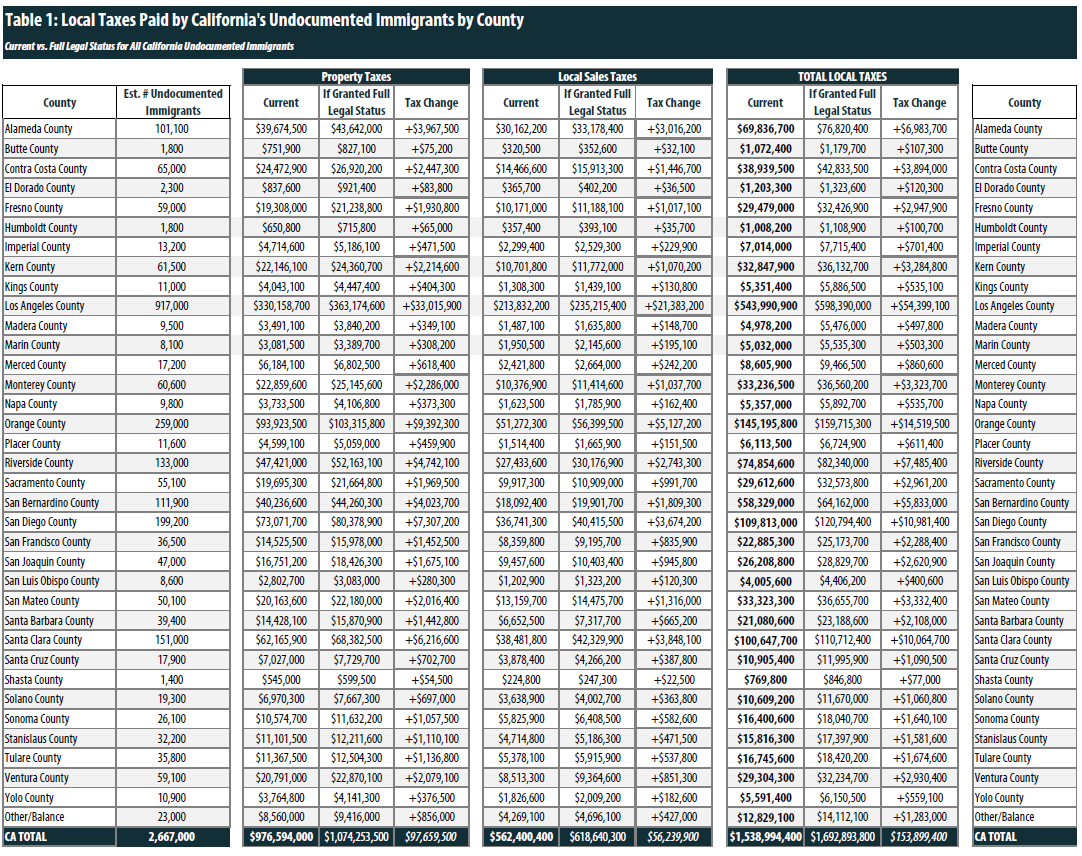

State And Local Tax Contributions Of Undocumented Californians County By County Data Itep

County Of Ventura Webtax Search For Property

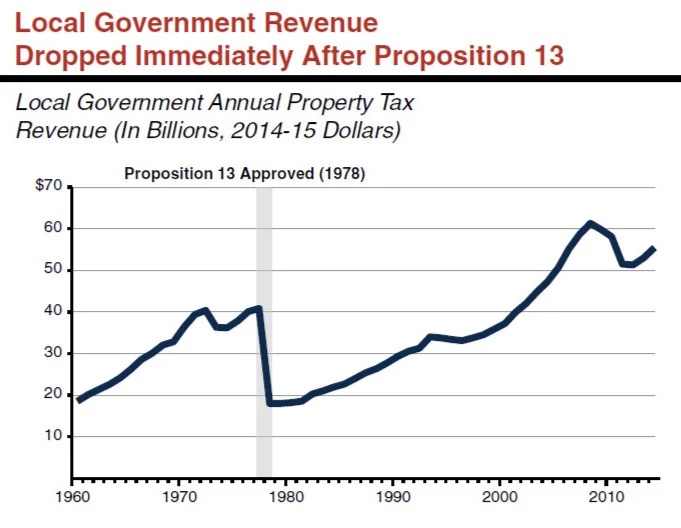

The Impact Of Prop 15 On Commercial Real Estate Lee Associates

31 Cent Property Tax Increase Approved For Maury County Homeowners

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

Will Your California Property Tax Skyrocket In 2020 Wynnecre Orange County Commercial Real Estate Experts